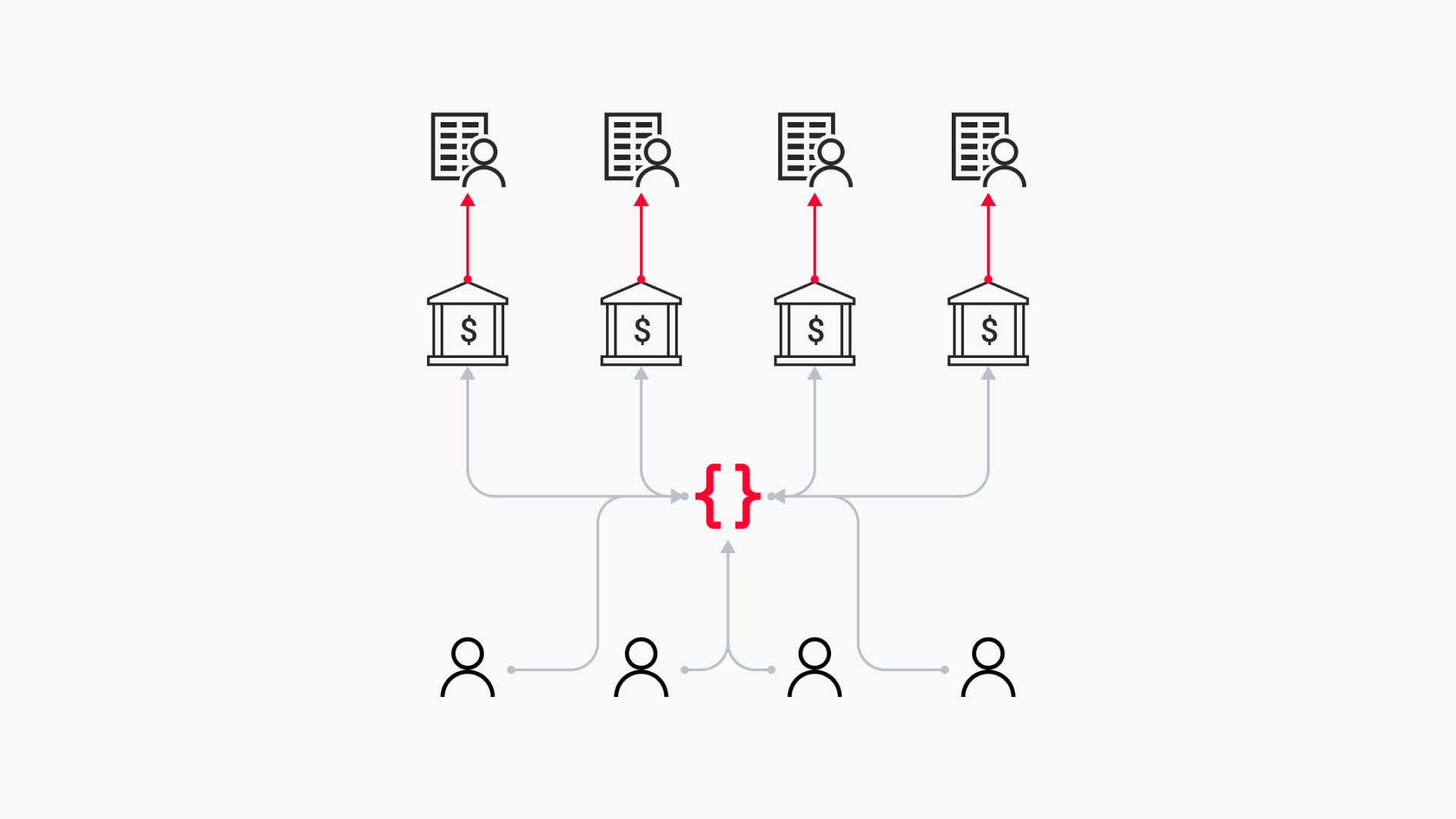

The ML optimization solution is operating as the interface between financial institutions and people wanting to get a loan (leads). The idea is to create a solution, which improves the process of finding the optimal pair of lender and financial organization, by building a model, which increases the efficiency of the request’s distribution between them. The implemented results can accelerate the profit growth in the main business model and offer the most relevant products to end-customers (leads).

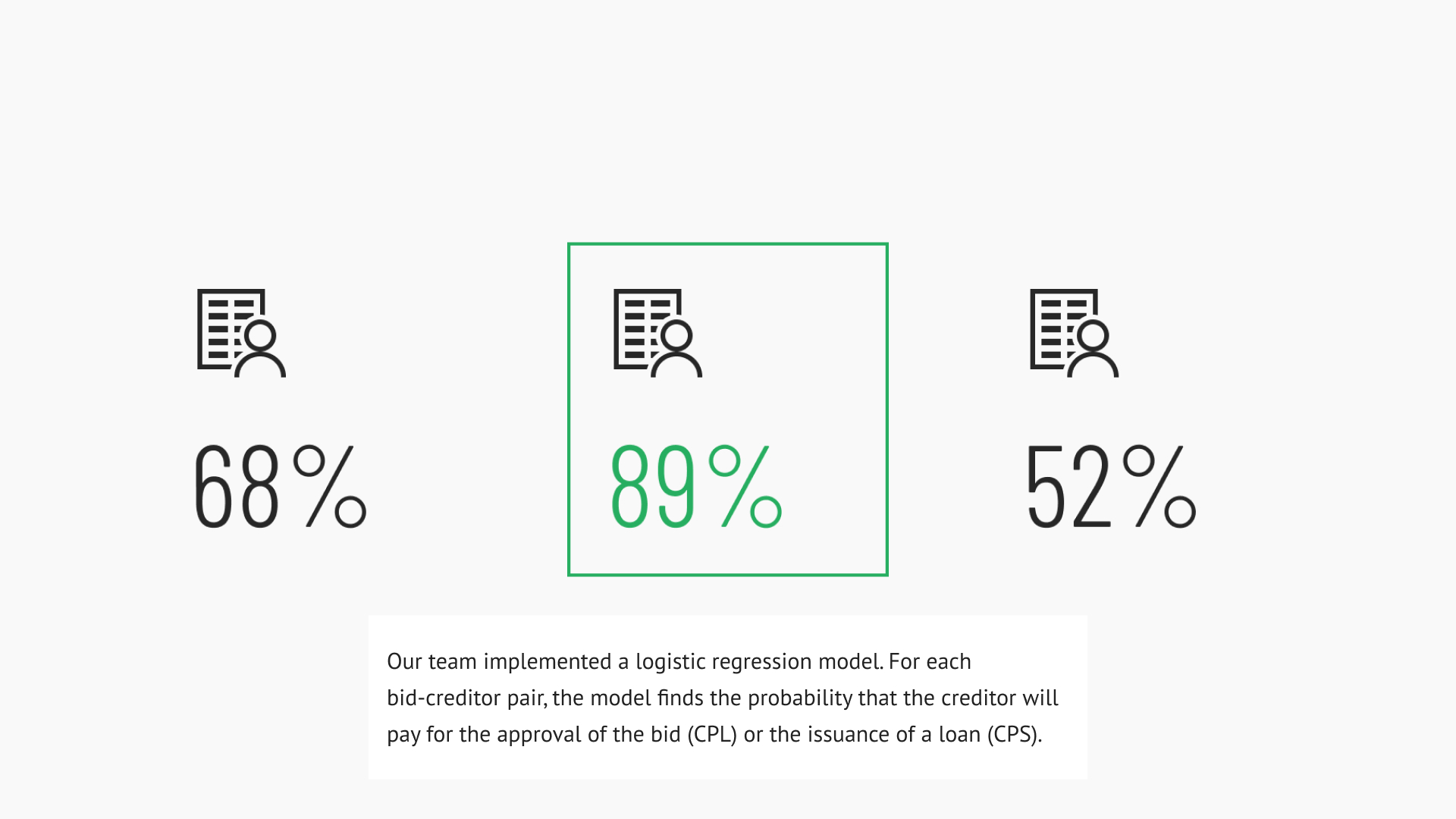

There are two types of profits in the current business model: accept of the request (CPL) and accept of the loan (CPS), so the main challenge was to adapt the model to the different origin of profits as a target variable.

We decided to build a few models for different types of financial organizations, whereas a dependent variable used each of two types of profits. As a result, the model can estimate the probability of CPL and CPS. Then, we can rank all the financial organizations for a given lead in terms of the expected amount of commission.

For estimating the quality of models we tried to predict how much profit we can get by integrating it. Models are based on 6-month historical data. Each lead was paired with a financial organization with the highest commission for CPL or CPS. As a result, the model gave an 18% profit growth.